How to calculate manufacturing overhead [Formula + examples]

Need help identifying the actual cost of your indirect expenses from product manufacturing? We’ll show you how. In this article, you’ll find the formulas and examples to achieve accurate calculations and mitigate inventory inefficiencies.

Learning how to calculate manufacturing overhead can help you employ better inventory management techniques and protect your business from going over budget.

What is manufacturing overhead? Manufacturing overhead, also known as factory overhead or manufacturing support costs, is the indirect cost of the production process. This can include expenses such as a supervisor’s salary or the annual lease of your production facility.

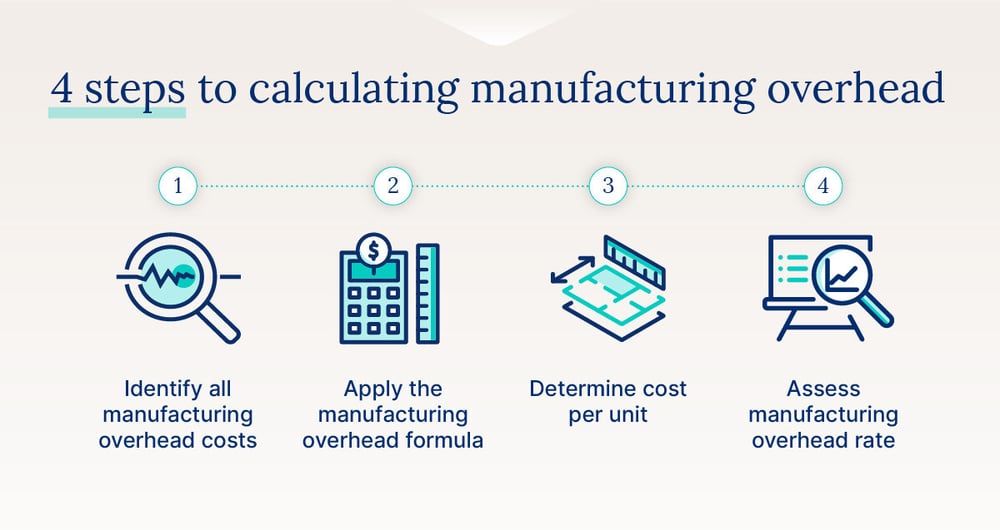

Within this blog, you’ll learn the four steps to calculating manufacturing overhead, the key formulas you need to know, and examples of how the calculations can help predict future costs. Let’s dive into the types of overhead costs.

1. Identify all manufacturing overhead costs

Manufacturing overhead costs include all indirect expenses related to the product production. Here are the most common types of overhead costs:

- Indirect materials: Materials that keep production moving but aren’t directly involved in the manufacturing of goods, like machine lubricants and cleaning supplies.

- Indirect labor: Labor involved in the production of goods but not directly related to the production of the goods themselves. This can include maintenance staff and supervisors.

- Utilities: Necessities for keeping operations going, like water and electricity.

- Physical costs: These include facility maintenance expenses and potential depreciation on manufacturing equipment.

- Financial costs: These costs involve interest on loans used to finance the production facility or insurance expenses.

It’s important to note that these are typically variable costs that may change year over year or even period over period. Keep this in mind when forecasting expenses to potentially reduce inventory costs.

2. Calculating the manufacturing overhead formula

Plug your numbers into one of the formulas below to get started using the manufacturing overhead formula. So, what is the formula for manufacturing overhead?

After adding together all of the indirect expenses necessary to produce your product, this formula will give you the total dollar amount of manufacturing overhead.

3. Determine the cost per unit

Once you calculate the total manufacturing overhead cost, you can use another formula to determine the cost of producing an individual unit. Here’s how to find manufacturing overhead cost per unit.

Understanding per unit cost is one of the inventory management best practices because it can help you accurately estimate how much it costs to create a single unit of your product. Let’s learn how to assess the manufacturing overhead rate to get an even clearer picture of how to predict indirect costs.

4. Assess manufacturing overhead rate

Knowing your manufacturing overhead rate can be helpful when integrating data into inventory management software. Your manufacturing overhead rate can help you forecast costs. This formula turns the total result into a percentage.

The manufacturing overhead rate is a key metric that helps businesses allocate indirect manufacturing costs to their products.

A low manufacturing overhead rate signifies efficient and effective resource utilization within your business. However, a higher rate may suggest your production process is experiencing delays or inefficiencies.

What are manufacturing overhead costs?

There are multiple manufacturing overhead costs that indirect costs can fall into. Manufacturing overhead includes:

- Fixed manufacturing overhead: These costs do not vary with the level of production or the number of units produced.

- Variable manufacturing overhead: These costs fluctuate in direct proportion to changes in the level of production or the number of units manufactured.

- Semi-variable manufacturing overhead: This is also known as mixed or semi-fixed costs and has elements of both fixed and variable costs.

To better grasp how these manufacturing overhead costs work in the real world, let’s learn from examples of manufacturing overhead next.

Manufacturing overhead examples

For a better understanding of how calculating manufacturing overhead can help your business, let’s take a look at a few real-world examples:

Example of fixed manufacturing overhead: In a textile manufacturing plant, the annual lease cost for the production facility remains constant regardless of whether the factory operates at full capacity or experiences a slowdown in production. The lease expenses are unchanging, making it a fixed cost.

Example of variable manufacturing overhead: A company producing smartphones experiences increased packaging materials costs proportional to the number of units produced. As production rises, the cost of packaging materials also rises. This fluctuating cost makes this expense variable, as it’s difficult to predict the exact expense.

Example of semi-variable manufacturing overhead: A supervisor’s salary may be fixed up to a specific production volume but become variable if a business needs additional shifts or overtime due to increased production.

These are just a few examples. Indirect costs vary widely, so always use your business’s internal data to determine the best inventory management decision.

Manage manufacturing costs with Cin7

Now that you know how to calculate manufacturing overhead, you can better budget for your indirect costs. If you want to fine-tune how you manage expenses, Cin7 can help you combat inventory inefficiency.

We help small businesses increase their efficiency with user-friendly inventory management software. From running health checks on your inventory and accounting systems to sharing relevant formulas to crunch the numbers, we’ve got your efficiency needs covered.

Start a free trial today.

FAQ

Still have questions about how to calculate manufacturing overhead? We’ve got answers.

How do you measure manufacturing overhead?

You can measure manufacturing overhead by identifying all indirect costs associated with the manufacturing process. You can add all the indirect costs together to get total manufacturing overhead costs and divide the total by the number of units produced to get the per-unit cost.

What are the different types of indirect costs related to manufacturing overhead?

Manufacturing costs can include indirect materials, indirect labor, utilities, physical costs, and financial costs. You can categorize these costs further as fixed, variable, and semi-variable manufacturing overhead types.

What is the difference between manufacturing overhead and total manufacturing cost?

Manufacturing overhead costs are indirect costs related to the production of processes, while total manufacturing costs encompass both direct and indirect expenses. Total manufacturing cost will give you a clear picture of your overall manufacturing costs, while manufacturing overhead can help you accurately determine the indirect costs of your manufacturing process.

More from the blog

View All Posts

How to calculate total manufacturing cost [formula + step-by-step guide]

Read More

What To Know About Batch Production: A Product Seller's Guide

Read More