What is a Good Inventory Turnover Ratio? [Formula]

A good inventory turnover ratio is typically between 4 and 8 for most industries. While the optimal ratio may vary depending on your industry, this range generally indicates a good balance between stock turnover replenishment and sales numbers.

No matter the size of your business, you’re sure to have some items that fly off the shelves and some that take a little longer to move. It’s ok if not all your items are best-sellers, as some will always sell faster than others. This just means you need to have a system in place to ensure you restock at the proper rate.

Inventory turnover ratio is the rate at which a company buys and sells its products. Companies use this ratio to make informed decisions about pricing, demand planning, and supply chain management.

This ratio, used in both large warehouses and small shops, helps determine how much inventory is utilized within a set time. Therefore, businesses can estimate new inventory requirements from that metric.

Stay with us as we unpack what inventory turnover is, how to calculate it, and what you can do to optimize your inventory turnover ratio.

Key Takeaways:

- Inventory turnover is the rate at which stock is purchased, used, and sold by a company.

- Calculate inventory turnover ratio by dividing cost of goods sold by average inventory value.

- The ideal inventory turnover ratio varies by industry, as more competitive industries must have a higher inventory turnover ratio, while less competitive markets can enjoy a lower one.

- You can optimize your inventory turnover ratio by adjusting your pricing, eliminating supply chain inefficiencies, reordering strategically, and automating your inventory management.

What is inventory turnover?

Inventory turnover illustrates the amount of time it takes for a company to purchase and sell an item, and is a good indicator of their efficiency regarding inventory management. By calculating inventory turnover, business owners can:

- Make inventory control decisions.

- Keep business running smoothly without going out of stock or overstocking the products.

For a business to flourish, it needs proper inflow and outflow of cash and inventory. It’s essential that businesses keep their shelves stocked so they can sell products and make profits. However, having obsolete inventory can be equally harmful to a business.

As a result, it’s crucial to optimize your inventory turnover ratio so it’s ideal for your specific business needs and aligns with industry standards. But how do you determine your specific inventory turnover ratio? Luckily, there’s a way to calculate it.

How to calculate inventory turnover ratio

The inventory turnover ratio formula is based on two main activities of a business:

- Purchases of the goods to be sold

- Selling of the goods

These are two determining factors in the success of any business, and you can only judge their performance by calculating the inventory turnover ratio.

- A high inventory turnover ratio tends to be best and generally means strong sales numbers.

- A low inventory turnover ratio illustrates either weak sales or overstocking, meaning the business is replenishing at a much faster rate than they’re selling.

While a higher turnover ratio typically represents stronger sales, companies can often struggle to meet surging demand, which, in some cases, can result in a stockout.

Inventory turnover ratio formula + example

There are multiple formulas to calculate inventory turnover ratio, but the most commonly used formula is:

Inventory turnover = Cost of goods sold / Average inventory

However, there are a few values you need to find before you can calculate inventory turnover itself. Here’s how the process breaks down with an example:

1. Calculate cost of goods sold (COGS)

To find the inventory turnover ratio, you first need to calculate the cost of goods sold (COGS). To find COGS, you’ll need to know the stock count of inventory value at the beginning of the month (beginning inventory) and at the end of the month (ending inventory). You’ll take the beginning inventory, add purchases made over the course of the month, and then subtract ending inventory to find COGS.

For example, say you’re a retailer selling perfume for $100 per bottle. You have 90 bottles at the beginning of September, making your beginning inventory $9,000, and 92 bottles at the end of September, making your ending inventory $9,200. Assuming you purchased 77 bottles over the course of the month, your COGS calculation would look like this:

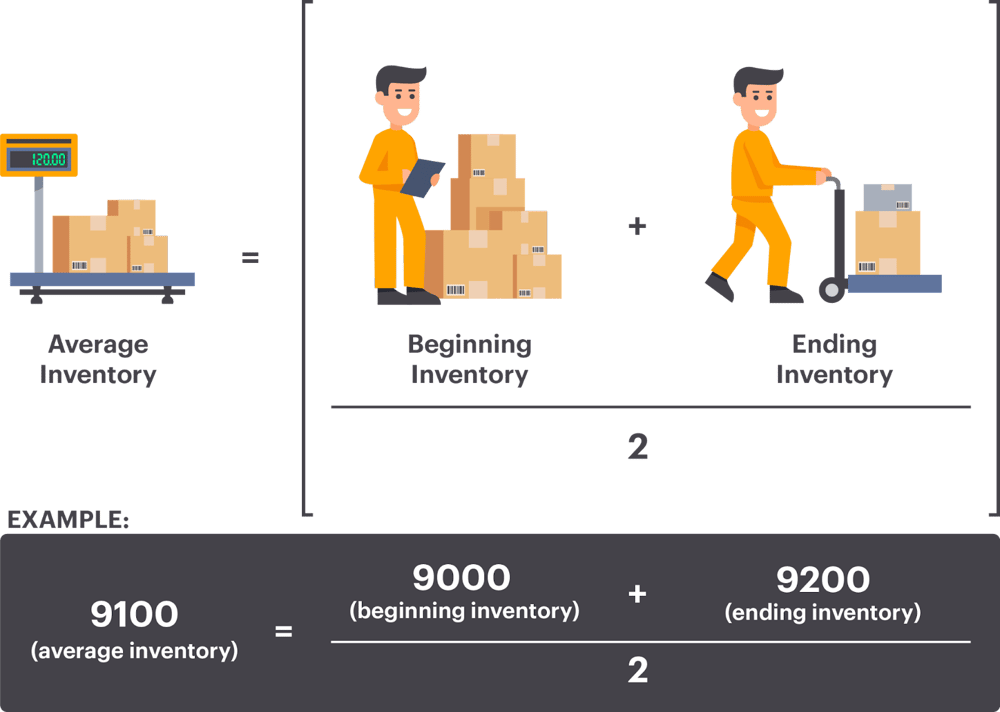

2. Calculate average inventory

Once you’ve found COGS, you can calculate your average inventory value. To find average inventory, you simply need to add your beginning inventory and ending inventory and divide the sum by two. For our perfume example, the calculation would look like this:

3. Calculate inventory turnover ratio

Once you’ve determined the COGS and average inventory, you can divide COGS by average inventory to find your inventory turnover ratio. This would be:

7,500/9,100 = 0.824

Our perfume retailer has an inventory turnover ratio of 0.8, meaning they replenish their inventory a little less than once a month. While this may seem low, remember that perfume is a luxury good, and retailers in this space can afford a lower turnover ratio. In the next section, we’ll explore how your industry affects your ideal inventory turnover ratio.

Factors Affecting Inventory Turnover

Several key factors influence a company’s inventory turnover ratio:

- Seasonality: Products in seasonal industries, such as fashion or outdoor equipment, experience spikes in demand at specific times of the year, affecting turnover rates.

- Product Lifecycle: Products at different stages of their lifecycle—from introduction to maturity and decline—impact turnover. New products may see faster turnover, while older products may slow down.

- Marketing Strategies: Promotions and sales campaigns can temporarily boost turnover rates, while insufficient marketing may result in excessive inventory and reduced turnover.

Understanding these factors allows businesses to better manage their inventory and align their strategies with market demands.

Inventory turnover ratio by industry

The nature of your industry and the products you sell will influence your ideal inventory turnover ratio. While a high ratio is vital in certain sectors, others can operate with lower turnover. Let’s look at the best inventory turnover ratios for different industries.

Industry-Specific Inventory Turnover Benchmarks

To effectively measure your inventory turnover rate, it’s important to compare it against industry-specific benchmarks. For example:

- Retail: High turnover, typically between 8-10, reflects rapid stock movement due to frequent purchases and lower profit margins.

- Automotive: A turnover rate of 6-8 indicates efficient stock management in an industry where parts and vehicles have longer lead times.

- Healthcare: With a turnover ratio of 3-5, healthcare businesses manage items like pharmaceuticals, balancing availability with regulatory compliance.

- Luxury Goods: A lower turnover ratio of 1-2 is common, reflecting the niche market and high-value items.

Understanding these benchmarks helps businesses gauge their performance and identify areas for improvement.

Industries with low margins

Industries with low margins need to maintain a high inventory turnover ratio to stay profitable. These are companies in particularly competitive industries, like grocers, retailers, and discount shops.

These companies should get products off the shelves quickly — unlike high-profit margin companies that can afford to make fewer sales due to selling more expensive products.

Industries with higher holding costs

Industries with higher holding costs additionally need to maintain a high inventory turnover ratio, as keeping items on the shelves is costly.

Take food and beverage companies that sell perishable goods. Since they must dispose of these products after a certain period, vendors must sell them quickly, thus maintaining a high inventory turnover ratio.

Industries selling luxury goods

Industries that sell luxury goods can enjoy a lower inventory turnover ratio since they operate in a niche market, unlike more competitive industries such as retail.

Jewelers, for example, can keep a lower inventory turnover ratio. This is because jewelers have high profit margins and often lower competition. This is all relative to scale, however, as a local business may not sell items as quickly as a national franchise.

Why is inventory turnover ratio important?

Maintaining a certain amount of stock to run a business smoothly is essential. The inventory turnover ratio helps determine how much inventory you need to keep shelves stocked while avoiding overstocking.

Additionally, knowing your inventory turnover ratio can answer supplementary questions about your business, such as:

- Am I pricing items correctly?

- Am I using the most efficient supplier?

- Am I restocking my most profitable items quickly enough?

By uncovering these answers, business owners can find more efficient ways to run their companies.

How to improve inventory turnover ratio

After determining the ideal inventory turnover ratio for your industry, you can optimize your own inventory turnover ratio. Here’s how:

1. Reevaluate your pricing

If you have a high inventory turnover ratio but low-profit margins, you’re likely pricing your products incorrectly.

Make sure you’re accounting for everything in your final price: raw materials, production costs, processing costs, etc. While raising your prices may lose a few customers, it’s necessary for long-term profitability.

2. Eliminate supply chain inefficiencies

Despite popular opinion, the cheapest suppliers aren’t always the best choice. If you’re struggling to meet market demand, you may want to opt for the most efficient supplier, to ensure you’re keeping your most popular products in stock.

To maintain an ideal inventory turnover ratio in your industry, it’s crucial you’re staying stocked with the correct items. Opting for the most efficient supplier is often the best way to ensure an optimal turnover ratio.

3. Rethink your reorders

It’s tempting to want to place bulk orders, as this usually results in supplier discounts. However, think about which items sell quickly and which aren’t. If certain items aren’t moving off the shelves, consider ordering them in smaller quantities.

If you continue ordering items in bulk that aren’t selling, you may wind up with excess inventory, which can be costly for a business. In some cases, just-in-time inventory management, which means only having the items needed for the given time, can optimize your turnover ratio.

4. Opt for automation

Opting for automation in favor of manual reordering is a great way to ensure you always stay on track and your inventory levels never get too low. Especially if you find yourself reordering too often and getting left with obsolete inventory, an automated inventory management system will notify you when your stock is getting low — and even reorder for you.

An automated system can track what items sell the best and ensure those items get replenished when inventory is low. Automation keeps a pulse on inventory levels and takes the stress out of reordering, so you can focus on running your business more efficiently.

Advanced Analysis Techniques

Advanced analysis methods can provide deeper insights into inventory management:

- Segmentation by Product Category: Breaking down inventory turnover by product categories can reveal which items are performing well and which are underperforming, helping to optimize stock levels.

- Geographic Location Analysis: Different regions may exhibit varying demand patterns. Analyzing turnover by location helps tailor stock levels to specific markets, improving operational efficiency.

- Efficiency Ratio: This ratio measures how effectively a company uses its assets to generate sales. Combining this with the inventory turnover ratio can highlight areas for improvement in overall efficiency.

Leveraging these techniques with inventory management software can enhance the accuracy of inventory forecasts and improve warehouse management, leading to better financial performance and customer satisfaction.

Frequently asked questions (FAQ)

Still have questions about finding a good inventory turnover ratio for your business? We’ve got you covered. Here are some of the most common questions (and answers) about nailing your inventory turnover ratio.

Is an inventory turnover of 4 good?

In most cases an inventory turnover of 4 to 8 illustrates a good balance of restocking and sales. For most retailers and e-commerce brands, a turnover ratio of 4 is considered healthy.

What is a low inventory turnover ratio?

A low inventory turnover ratio signals that sales are weak and inventory isn’t moving off the shelves. Many industries consider an inventory ratio under 4 a low turnover ratio.

Why is a low inventory turnover ratio bad?

A low inventory turnover ratio typically shows either weak sales or a lack of demand in your industry. In some cases, a low ratio will illustrate an imbalance between how frequently you’re restocking items and your actual sales numbers.

What should you do about a low inventory turnover ratio?

Our tips above are all great strategies to implement if your business has a low inventory turnover ratio. If you have a low inventory turnover ratio, consider reevaluating your prices, streamlining your supply chain, or automating your reorder system.

What does an inventory turnover of less than one mean?

If you have an inventory turnover of one or less than one, you have too much stock. For example, if you sell 50 items over a year and always have 50 units of inventory in stock, you’d have a rate of one. However, this is far more inventory than is needed to meet demand — meaning you’ve significantly overstocked.

Can an inventory turnover ratio be too high?

For most businesses, a high inventory turnover ratio is generally a sign of strong sales numbers. However, a high inventory turnover ratio, and high sales, requires you to keep up with demand. If you can’t keep up with demand, you won’t be able to meet customer demand and may experience stockouts.

What is an ideal inventory turnover ratio?

The ideal inventory turnover ratio depends on your business and industry. But regardless of what you sell, it’s still essential to know your current ratio so you can improve upon it.

Opting for an automated inventory management system is an excellent way to ensure you always get notified when stock is low and it’s time to replenish. An automated system will also calculate your cost of goods sold and give you real-time insights — so you never miss a beat.

Stay on top of turnover with Cin7 Core.

More from the blog

View All Posts

Mastering annual stock count and inventory turnover: Essential tips for a smooth transition

Read More

6 Holiday Inventory Management Challenges and How to Solve Them

Read More